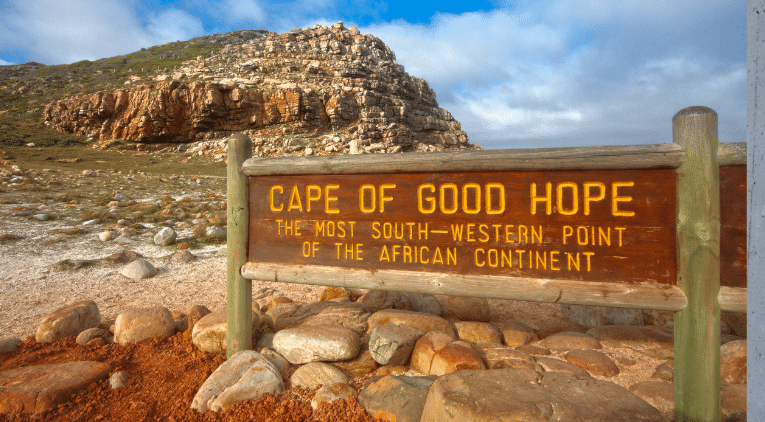

Africa is a continent full of breathtaking landscapes, diverse wildlife, and vibrant cultures, offering unforgettable experiences for travelers. From safaris in Kenya to exploring ancient pyramids in Egypt, every corner of the continent has something unique to offer. Having the right travel insurance allows you to focus on the adventure ahead...so get 1Cover Travel Insurance, the One thing you need when One thing goes wrong.

Unlimited medical benefits should you get sick or have an accident including 24-hour emergency medical assistance, ambulance fees and medical evacuations.

Cover for luggage and personal effects stolen, lost or damaged during travel.

We cover you for your reasonable additional accommodation and travel expenses when your transport is cancelled, because of reasons like unexpected weather events.

Choose your level of cover for cancellation fees and lost deposits for pre-paid travel arrangements due to unforeseen circumstances.

Cover for the replacement cost of your travel documents including passports, travel documents or travellers cheques lost or stolen from you during your Journey.

Please refer to the PDS and policy schedule and check if your sickness or injury is a claimable event and is covered. If you are hospitalised, or if you are treated as an outpatient, or if the total cost of the treatment will exceed $1000, please contact our emergency assistance service as soon as possible to obtain their prior approval.

In circumstances where the claim is approved, we can then provide written guarantees of payment of reasonable expenses for emergency hospitalisation that may be required while you are in Africa.

Yes, of course. If you want to extend your policy while you’re in Africa, the easiest way to do this is via the Policy Manager.

You'll need your policy number (available in the email confirming your policy), and a few other simple details. Log-in and extend your trip, add destinations, or buy add ons/extras.

Make sure you extend your policy before it expires (please keep in mind Australian AEST/AEDST).

If you have trouble, you can email us at [email protected]

Please note there may be instances where a policy extension is not available.

If you are robbed while you’re in Africa, you should report the theft to the police or nearest local authority immediately. You will also need to obtain a written report to be used as supporting documents for your claim.

If you are entitled to be reimbursed by the bus line, airline, shipping line or rail authority you were travelling on when the loss, theft, misplacement or damage occurred, then your travel insurance may not cover you.

However, if you are not reimbursed the full amount of your claim, we will assess your claim and you may be entitled to be paid the difference between the amount of your loss and what you were reimbursed, up to the limit of your cover (allowing for depreciation due to age, wear and tear).

Our Comprehensive, Overseas Frequent Traveller, and Already Overseas policies, rental vehicle insurance excess cover is not included automatically. Under these policies, you can add cover for rental vehicle insurance excess up to $10,000 by paying an additional premium

In the event of a terrorist attack or political unrest, there is no cover for cancellation fees and lost deposits, disruption of journey or alternative transport expenses.

However, if you do get caught up in an unforeseen event while you are in Africa and you are injured, cover is available for all necessary medical/hospital expenses.

You may choose your own medical advisor, or we can appoint an approved medical advisor to see you.

Please note: if you do not get the medical treatment you expect, although we can assist you, 1Cover are not liable for anything that results from that treatment. If you are unwell overseas please contact us.

When you apply for a policy you need to tell us where you are travelling to. The premium you pay for the policy depends on your destination(s).

If you're travelling to multiple countries, you need to nominate the countries when you are applying for cover.

If you’re going on a cruise, you must select the appropriate cruise region for where you are travelling and pay an additional premium for travel on a cruise vessel by purchasing the Cruise Pack. If you don't purchase a cruise pack, you won't be covered while on the ship. There is, however, no cover under any sections of the policy when you are on a cargo ship or freighter.

We have a policy called Frequent Traveller which allows you to take as many trips under the one policy for 12 months and enjoy comprehensive cover on each one. There is a limit to the maximum length of each trip on these policies. You can travel to one or more destinations with this policy.

Find out more about our annual travel insurance policies here.

Laptop computers, cameras, mobile phones…they’re all things we need on at home and on holiday. That’s why you can choose a bit of extra protection for your can’t-live-withouts. All you need to do is include and specify certain high-value items that aren't automatically covered when you're buying your policy.

Note: the items cannot be older than 12 month, and you can't specify items like jewellery, watches, bicycles and watercraft (apart from surfboards).

Travel insurance provides cover for weather events as long as they are unforeseen. Our policies do not cover claims for losses caused by an event that you were aware of at the time of purchasing your policy.

Once an event has become published in the mass media, it is expected that you have purchased your insurance with this knowledge in mind. 1Cover will, where possible, issue travel warnings in relation to such large scale events and the dates and times after which they are not seen as an unforseen event.

Overseas Emergency Medical Assistance: Includes 24-hour emergency medical assistance, ambulance fees, medical evacuations, funeral arrangements, and messages to family and hospital guarantees.

Overseas Emergency Medical And Hospital Expenses: Cover if you are injured or become sick overseas, including; medical, hospital, surgical and nursing.

Dental Expenses: Cover for your emergency dental treatment for the relief of sudden and acute pain to sound and natural teeth.

Additional Accommodation & Travel Expenses: Cover for additional travel expenses if you cannot travel because of an injury or sickness (whilst overseas).

Family Emergency: Cover for additional travel expenses if your travelling companion, or a Relative of either of yours, dies unexpectedly, is disabled by an injury or requires hospitalisation.

Emergency Companion Cover: Cover for additional travel and accommodation expenses if your travelling companion cannot continue their Journey because of an injury or sickness.

Resumption Of Journey: Cover for the cost of airfares for you to resume your journey if you return home because of the unexpected death or hospitalisation of a relative of yours.

Hospital Cash Allowance: Hospital Cash Allowance

Permanent Disability: A permanent disability benefit is payable for total loss of sight in one or both eyes or loss of use of a hand or foot (for at least 12 months, and which will continue indefinitely) within 12 months of, and because of, an injury sustained during your journey.

Loss Of Income: A weekly loss of income benefit is payable if you become disabled within 30 days of an injury you sustained during your journey, and you are still unable to work more than 30 days after returning to Australia.

Credit Card Fraud & Replacement: Cover for the replacement cost of your credit cards lost or stolen from you during your journey, and loss resulting from fraudulent use.

Travel Documents & Traveller's Cheques: Cover for the replacement cost of your travel documents including passports, travel documents or travellers cheques lost or stolen from you during your Journey.

Theft Of Cash: Cover for the following items stolen from your person; banknotes, cash, currency notes, postal orders and money orders.

Luggage & Personal Effects: Cover for luggage and personal effects stolen, lost or damaged during travel. Common claims include luggage, personal effects, cameras, spectacles and a computer.

Luggage & Personal Effects Delay Expenses: Cover to purchase essential items of clothing and other personal items following Luggage delayed and Personal Effects being delayed, misdirected or misplaced by your carrier for more than 12 hours.

Cancellation Fees And Lost Deposits: Covers cancellation fees and lost deposits for pre-paid travel arrangements due to unforeseen circumstances neither expected nor intended by you, and which are outside your control, such as; sickness, injuries, strikes, collisions, retrenchment and natural disasters.

Disruption Of Journey: Cover for additional meals and accommodation expenses, after an initial 6 hours delay, if your Journey is disrupted due to circumstances beyond your control.

Alternative Transport Expenses: Cover for additional travel expenses following transport delays to reach events such as; a wedding, funeral, conference, sporting event and pre-paid travel/tour arrangements.

Personal Liability: Cover for legal liability including legal expenses for bodily injuries or damage to property of other persons as a result of a claim made against you.

Rental Vehicle Excess: Cover for the excess payable on your rental vehicle's motor vehicle insurance resulting from the rental vehicle being; Stolen, crashed or damaged and/or cost of returning the rental vehicle due to you being unfit to do so.

We can’t stop things going wrong when you travel, but there are lots of situations we can help you out with.

You wouldn’t be going to Africa if you weren’t going to be doing some activities. Find out about our Adventure & Sports Pack to be covered for adventure sports.

All sorts of medical issues could affect your travel in Africa. Find out about pre-existing medical conditions, as well as pregnancy and emergencies.

We always recommend you read the PDS, but this page will give you an overview of what travel insurance will cover in Africa.